A gateway to tax efficiency

When it comes to corporate taxation, the Netherlands offers a unique feature known as the Dutch participation exemption. This exemption can significantly impact how your company approaches its international tax strategies. If you’re keen to understand how this could benefit your business, it’s worthwhile exploring Duijn Tax for expert insights. Let’s delve into the key aspects of the Dutch Participation Exemption and how it can be leveraged for your financial advantage.

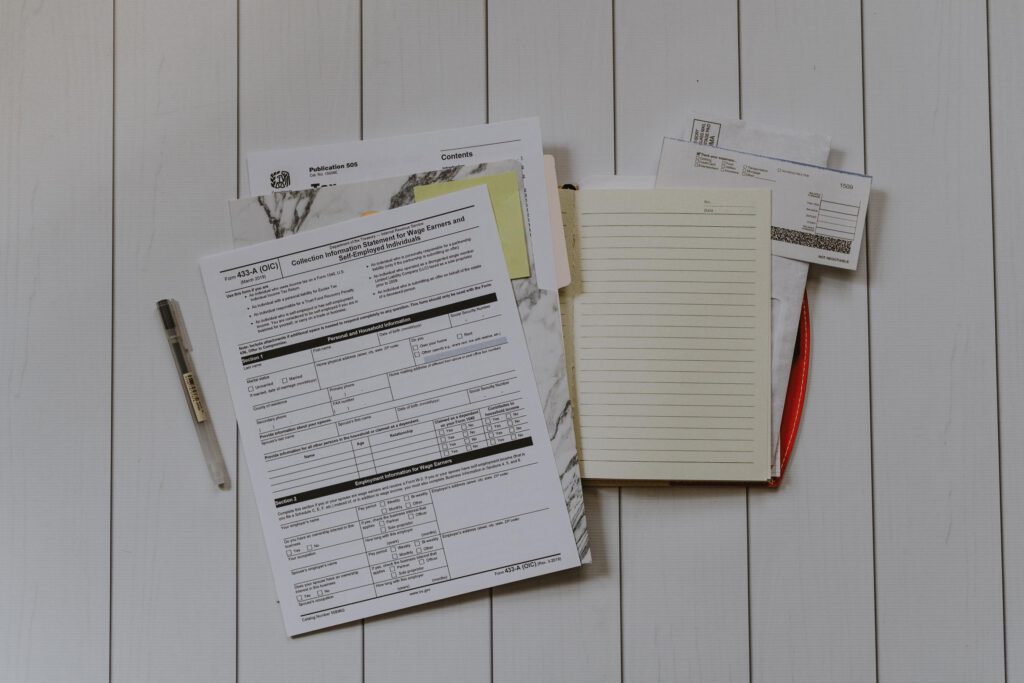

Understanding the basics of Dutch participation exemption

The Dutch Participation Exemption is designed to prevent the double taxation of profits that come from a substantial shareholding in a subsidiary. In essence, if your company owns at least 5% of the shares in another company, dividends and capital gains from that shareholding are exempt from Dutch corporate tax. This rule applies regardless of whether the subsidiary is based in the Netherlands or abroad, making it an attractive aspect of Dutch corporate tax law for multinational companies. To benefit from the Dutch Participation Exemption, certain conditions must be met. The subsidiary should not be a so-called “passive investment company,” and its activities must be primarily business-driven. Additionally, the shares must not be held as mere portfolio investments. Understanding these criteria is crucial to determine whether your company can take advantage of this exemption.

Strategic implications for international business

The Dutch Participation Exemption can be a game-changer for companies engaged in international business. By strategically structuring your holdings, you can optimize your global tax position. This exemption makes the Netherlands an attractive location for holding companies, providing a pathway to efficient global tax planning and structuring. However, it’s essential to navigate these waters carefully, considering the ever-evolving global tax environment and anti-abuse rules. The Dutch Participation Exemption is a powerful tool in the realm of international corporate taxation. It offers significant benefits for companies with international operations, allowing them to streamline their tax strategies and enhance profitability. As with any tax strategy, it is advisable to consult with tax professionals to fully leverage this exemption while remaining compliant with all regulatory requirements.